When you walk down the aisle at your local drugstore or scroll through your favorite beauty site, you’re not just picking a lipstick or a moisturizer-you’re choosing a brand. And behind every product is a company shaping what beauty means today. The cosmetic industry isn’t just about pretty packaging or viral TikTok trends. It’s a billion-dollar global machine driven by innovation, science, and shifting consumer values. So who’s really leading the pack in 2025?

Estée Lauder Companies

Estée Lauder Companies isn’t just one brand-it’s a whole ecosystem of beauty. They own over 25 names you know well: Estée Lauder, MAC, Clinique, Bobbi Brown, Too Faced, and Smashbox. Their strength? Mastering both luxury and mass-market appeal. In 2024, they reported $17.8 billion in revenue, with skincare making up nearly 60% of sales. They’re not just selling makeup; they’re selling science-backed routines. Their Advanced Night Repair serum has sold over 300 million bottles since 1982. That’s not luck. That’s strategy.

L'Oréal Paris

L'Oréal is the giant that no one else can match. Headquartered in France, they own 36 brands including L'Oréal Paris, Maybelline, Garnier, Kiehl’s, and YSL Beauty. In 2024, they pulled in over €37 billion in sales. What sets them apart? Scale and research. They have over 4,000 scientists working across 12 R&D centers worldwide. Their AI-powered skin analysis tool, SkinCeuticals’ SkinType, is now used in over 10,000 salons. They’re also leading in clean beauty-Garnier’s Green Beauty line uses 100% recyclable packaging and 95% natural-origin ingredients.

Procter & Gamble (P&G) - Oral-B, Olay, SK-II

You might not think of P&G as a cosmetic company, but they’re quietly dominating skincare and haircare. Olay alone generated $2.3 billion in 2024. Their Regenerist line uses patented niacinamide and peptide blends backed by 20+ clinical studies. SK-II, their premium Japanese brand, is a cult favorite in Asia. Its signature ingredient, Pitera™, is a yeast ferment that’s been clinically shown to improve skin texture in 87% of users after 8 weeks. P&G’s strength? They don’t chase trends. They build products that last.

Unilever - Dove, Pixi, Tatcha, Love Beauty and Planet

Unilever’s beauty portfolio is a masterclass in diversity. Dove, with its 80-year legacy, still leads in body wash sales globally. But they’ve also acquired newer players like Pixi (known for glowing serums) and Tatcha (Japanese-inspired luxury skincare). Love Beauty and Planet targets eco-conscious buyers with plant-based formulas and bottle recycling programs. In 2024, Unilever’s beauty division grew 7% year-over-year, driven by emerging markets in Southeast Asia and Latin America. Their secret? Balancing affordability with authenticity.

Shiseido Company

Japan’s oldest cosmetic company, founded in 1872, still leads in innovation. Shiseido doesn’t just make products-they study skin biology. Their Ultimune Power Infusing Concentrate uses patented immunotherapy tech to strengthen skin’s natural defenses. In 2024, they launched their first AI-driven skin diagnostic app in partnership with Fujitsu. It analyzes 12 skin parameters using just a smartphone photo. Shiseido’s global sales hit $11.2 billion, with 45% coming from outside Japan. They’re the quiet powerhouse behind many high-end department store counters.

Chanel

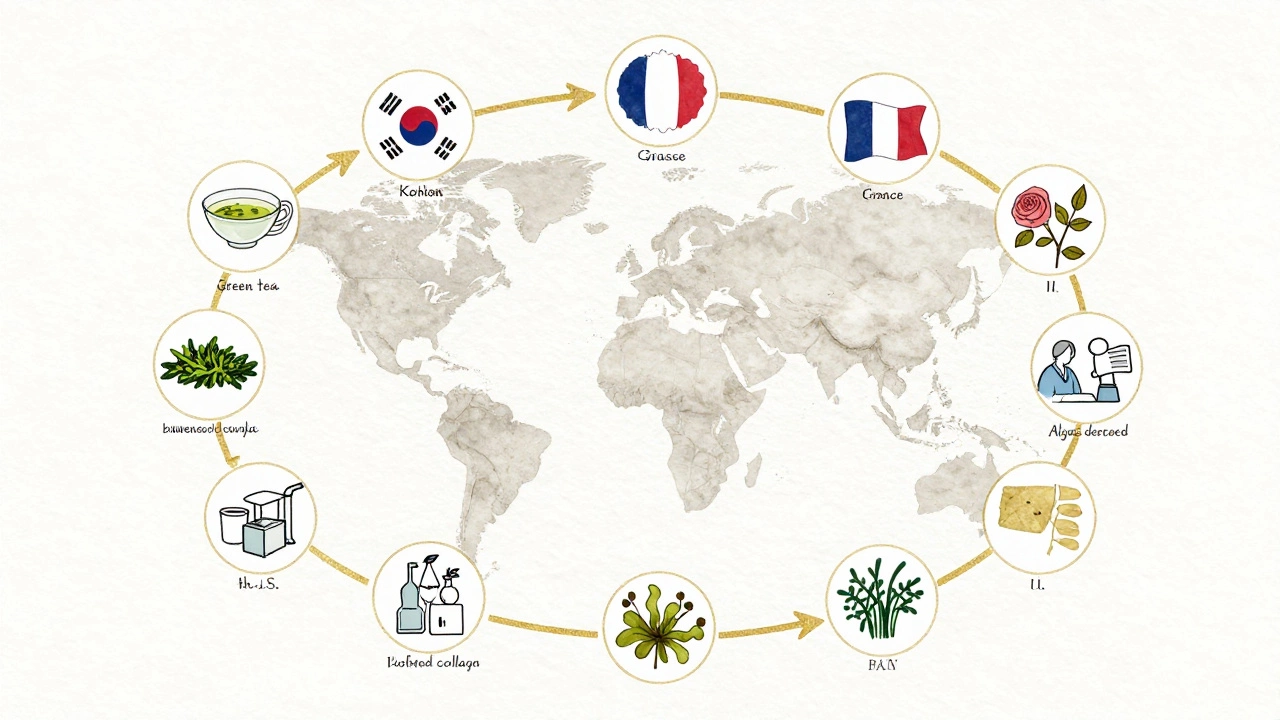

Chanel isn’t just about the little black dress. Their Rouge Coco Lipstick, launched in 1953, is still one of the best-selling lip colors in the world. In 2024, Chanel Beauty generated $5.8 billion in revenue. Their secret? Exclusivity and heritage. They own their own rose fields in Grasse, France, to ensure the purity of their fragrance ingredients. Their Le Volume de Chanel mascara is formulated with 97% natural-origin ingredients and uses a patented brush design that lifts lashes without clumping. Chanel doesn’t advertise on social media. They don’t need to. Their brand carries its own weight.

LVMH - Dior, Fenty Beauty, Benefit, Marc Jacobs Beauty

LVMH owns the most star-studded beauty lineup in the world. Dior’s Rouge Dior lipstick is a status symbol. Fenty Beauty, founded by Rihanna in 2017, revolutionized foundation shades with 50 options at launch-now expanded to 60. In 2024, Fenty Beauty hit $1.2 billion in annual sales, making it the fastest-growing luxury beauty brand ever. Benefit, known for their brow gels and cheek products, still dominates the “fun beauty” space. LVMH’s edge? They let each brand keep its personality while sharing global logistics and R&D.

Revlon

Revlon might not be the flashiest name anymore, but they’re still a force. Founded in 1932, they pioneered the first mass-market nail polish. Today, they’re making a comeback with clean, affordable formulas. Their ColorStay foundation is still the #1 best-selling long-wear foundation in the U.S. Their 2024 relaunch focused on inclusive shades and recyclable packaging. They partnered with a U.S.-based lab to develop a new vegan collagen alternative derived from fermented algae. Revlon’s comeback proves legacy brands can evolve-if they listen to the customer.

Amorepacific

South Korea’s beauty giant doesn’t get enough global attention, but they should. Amorepacific owns 35+ brands, including Sulwhasoo, Laneige, Innisfree, and Etude House. They’re the reason K-beauty became a global phenomenon. Their research on fermented ingredients like green tea and rice bran has led to patented tech like the “Gentle Fermentation Process” used in Innisfree’s Green Tea Serum. In 2024, they reported $7.3 billion in sales, with 30% coming from North America and Europe. Their stores in New York and Paris sell out within hours of new launches. They’re the quiet innovators behind the glass skin trend.

The Estée Lauder Companies (again, because they’re that big)

Wait-we already mentioned Estée Lauder? Yes, and it’s worth repeating. They’re not just a company. They’re the blueprint. They acquired Too Faced in 2016 and saw sales jump 300% in three years. They bought Dr. Jart+ in 2019 and turned a Korean skincare brand into a global phenomenon. Their acquisition strategy is simple: find brands with loyal followings, then scale them with global distribution. They’re the only company that owns both a cult-favorite indie brand (Too Faced) and a clinical skincare leader (Clinique). That’s why they’re #1.

Why These Companies Dominate

It’s not just marketing. These companies invest heavily in three things: research, sustainability, and inclusivity. They’re not just selling color-they’re selling solutions. Skin barrier repair, blue light protection, hyperpigmentation correction, microbiome balance-these are now standard claims. Brands that ignore science are fading. Those that embrace transparency and ethics are thriving. The winners in 2025 aren’t the ones with the fanciest ads. They’re the ones with the strongest labs, the cleanest supply chains, and the most honest communication.

What’s Changing in 2025

Two big shifts are reshaping the game. First, AI-driven personalization. Brands like L'Oréal and Shiseido now offer skin diagnostics via apps that recommend products based on your environment, sleep patterns, and even stress levels. Second, ingredient traceability. Consumers want to know where every ingredient comes from. Brands like Amorepacific and Unilever now use blockchain to track ingredients from farm to bottle. If you can’t prove it, you won’t sell it.

Final Thoughts

There’s no single “best” cosmetic company. It depends on what you need. Need clinical results? Go for Estée Lauder or Shiseido. Want clean, affordable options? Try Garnier or Dove. Crave luxury and exclusivity? Chanel and Dior deliver. The real takeaway? The top brands aren’t just selling products-they’re building trust. And in 2025, trust is the most valuable ingredient of all.

Hair Care

Hair Care